Wise

Wise is a peer-to-peer currency exchange service that allows its users to send money overseas easily and inexpensively.

Traditionally, large financial institutions dominated cross-currency transactions, charging hefty fees (often several percent of the amount sent) and taking hours or days to settle the trade. By coordinating transfer needs within countries across its massive user base, Wise makes transferring money more efficient and passes considerable savings along to users.

wise.com/us

Taxfix

Making complex tax systems accessible to everyone, Taxfix allows users to submit tax returns quickly and easily via app or web.

Tax filing with forms takes hours and requires expert knowledge. Taxfix disrupts the industry by offering an easy solution that guides users through the process of filing their taxes by asking them simple questions – as a tax advisor would. With its underlying tax engine, Taxfix's systems can generate the smartest questions and achieve the best refund for its customers.

taxfix.de/en

Parker

Parker's mission is to increase the number of financially independent people by providing the tools that enable independent business owners to scale their businesses profitably.

Parker's first product combines a corporate card with dynamic spending limits and software tooling to help businesses grow and optimize their profitability.

getparker.com

Novo

Novo is the award-winning, powerfully simple business banking platform built for small businesses.

Big banks don’t provide the access, assistance and modern tools that small business owners need to successfully grow their business. Novo is on a mission to increase the GDP of the modern small business by creating the go-to banking platform for SMBs as well as tools to help them save time and increase their cash flow.

www.novo.co

Albo

albo is the leading Mexican neobank focused on middle/low income people and SMBs offering debit, credit, savings, and crypto products.

www.albo.mx

Petal

Petal is a new kind of credit card company on a mission to make credit honest, simple, and accessible.

Petal expands access to safe and affordable credit by underwriting cash flows instead of just credit scores, and helps users build credit and achieve better financial outcomes with behavioral science and smart, intuitive product design.

(Acquired by Empower Finance, April 2024)

www.petalcard.com

Atlas

Atlas is building a members-only charge card for last minute access to coveted experiences.

atlascard.com

Regate

Regate is an accounting automation platform that streamlines accounting and financial processes for SMEs.

Designed as an intuitive all-in-one solution, Regate helps automate recurring tasks, centralize financial data and report actionable insights in real-time.

(Acquired by Qonto, March 2024)

en.regate.io

N26

N26 is building the first mobile bank the world loves to use. Founded in 2013 with a vision to change the world's relationship with money for the better, it has redesigned banking for the 21st century and is available 24/7 on Android, iOS, and desktop.

With state-of-the-art technology and no branch network, N26 is the first 100% mobile bank to receive a full banking license from the European Central Bank. Their intuitive, secure and seamless experience has been designed to empower everyone to achieve financial freedom with confidence.

n26.com/en-eu

Octane

Octane is revolutionizing recreational purchases by delivering a seamless, end-to-end digital buying experience. Octane connects people with their passions by combining cutting-edge technology and innovative risk strategies to make large lifestyle purchases – such as motorcycles, ATVs, snowmobiled and RVs – fast, easy, and accessible.

octane.co

Link

Link is on a mission to help businesses significantly reduce payment costs using open banking infrastructure.

Link provides businesses with an open-banking powered low-cost online payments solution. Link's seamless checkout experience enables consumers to pay with their bank accounts, driving significant cost savings to merchants.

www.link.money

Shares

Shares is the social investing app that helps people build their wealth through a community of peers and expert investors.

With Shares, everyone from investing rookies to financial veterans can buy stocks, ETFs and cryptocurrencies, spark conversations and learn from the best – all in a single app. Launched in the UK and expanding across the EU, Shares is on a mission to bring people together to build better financial futures.

shares.io

Velocity

Velocity is building the future of business financing in India.

Businesses in India have evolved but financial products haven’t. Velocity unlocks a company's growth by providing eCommerce analytics tools and revenue-based financing. Velocity also offers a first-of-its-kind corporate credit card, a seamless payments management platform, and much more to empower digital first businesses in India.

www.velocity.in

Simpl

Simpl is a checkout network in India that builds consumer trust in ecommerce by improving the user experience.

Traditionally, large ecommerce platforms have marginalized small and medium sized merchants selling online by owning the user experience and trust. Simpl is leveling the playfield for all by democratizing the checkout and post purchase experience in ecommerce transactions.

getsimpl.com

Majority

MAJORITY is the first mobile banking app dedicated to providing migrants with the tools they need to succeed and thrive in the US.

MAJORITY is breaking down the barriers of banking and offering affordable cross-border services. For a low monthly fee, MAJORITY members in the U.S. gain access to key banking services, including an FDIC-insured account and Visa® debit card; plus, no-fee money transfers and low-cost international calling to help them connect home and support loved ones.

www.majority.com/en

One Trading

One Trading's goal is to bridge the gap between crypto and traditional asset trading with a single regulated trading venue for all customer types.

While offering both a regulated exchange and OTC desk, the company uses institutional grade technology to provide for the listing of securities and trading of spot, derivatives and structured products. One Trading brings trust and transparency to crypto markets.

onetrading.com

LiveFlow

LiveFlow is an accounting and finance automation platform with a mission to help businesses better manage and understand their financials.

SMBs rely heavily on accounting firms to simplify their financials, but these firms are increasingly overwhelmed by manual, repetitive tasks. LiveFlow equips finance teams with tools to automate their mundane tasks, enabling them to serve more clients with fewer resources.

www.liveflow.com

Panacea

Created by doctors for doctors, Panacea offers customized banking products to assist through all career stages. From transitioning to residency to refinancing student loans to starting a new practice, Panacea is there for physicians, dentists, and veterinarians as their financial partner and is uniquely positioned to create the leading financial services company for doctors across the U.S.

panaceafinancial.com

Qonto

Qonto is the leading European business finance solution. It simplifies everything from everyday banking and financing to bookkeeping and spend management. With its fast and innovative product, highly responsive customer service, and transparent prices, Qonto energizes SMEs and freelancers so that they can achieve more.

qonto.com/en

Bitpanda

Bitpanda simplifies wealth creation. Founded in 2014, Bitpanda exists to help people trust themselves enough to build financial freedom for their future.

With low fees, 24/7 trading, and real-time settlement, Bitpanda empowers both first-time investors and seasoned experts to invest in the cryptocurrencies, crypto indices, stocks, precious metals and commodities they want. So that they can shape their financial futures - on their own terms.

www.bitpanda.com/en

BukuWarung

BukuWarung's mission is to accelerate the financial success of small merchants in Indonesia.

BukuWarung provides an operating system to merchants that enables them to track business transactions, accept payments from customers, send payments to suppliers, buy digital services with an in-app wallet and give credit with underlying payment transactions.

bukuwarung.com

Bestow

Bestow is a leading enterprise platform transforming how life insurance and annuities are built, sold and serviced. Designed for top carriers, Bestow delivers modern infrastructure across quoting, application, underwriting, policy issuance, administration and in-force management. By consolidating fragmented systems into a single platform, Bestow helps accelerate product launches, reduce costs and unlock new growth opportunities for some of the world's largest insurers, including USAA, Transamerica and Nationwide.

www.bestow.com

Mondu

Mondu is driving innovation in B2B payments by putting customers in the heart of the payment flow and ensuring a seamless, state-of-the-art user experience.

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms, both online and offline. As a result, businesses are empowered to purchase and pay when they want, leading to higher conversion and average order value, and driving growth for merchants and marketplaces.

www.mondu.ai

Xero

Xero provides cloud accounting software and services for small businesses and their advisors.

Xero fills the gap between legacy accounting systems trapped on the desktop and ad hoc systems by providing one clean and intuitive package with a full accrual accounting system, including cashbook, automated daily bank feeds, invoicing, payroll, sales tax and reporting.

(Initial Valar investment October 2010; final exit June 2020)

www.xero.com/us

Kuda

Kuda, “the money app for Africans,” is on a mission to make financial services more accessible, affordable and rewarding for every African on the planet.

Beginning with Nigeria and the UK, Kuda is giving Africans – whether on the continent or in the diaspora – a better alternative to traditional finance by delivering services including free money transfers, business banking, automated savings, investments and instant access to credit through digital devices.

kuda.com

Hero

Hero is on a mission to disrupt the financial landscape for digital sellers across Europe. By providing a large range of instantly available credit options, its primary focus is to resolve the working capital crunch while saving its clients time and money.

Hero’s unified Financial Operating System brings banking, payments, and credit services under one roof. Available 24/7, its robust infrastructure massively enhances digital sellers' growth, operational efficiency, and financial flexibility.

www.heropay.co

Stash

Stash is an investing and banking app that simplifies personal finance for millions of everyday Americans.

Ninety-five percent of Stash customers are beginner and first-time investors who aspire for a better future for themselves and their families. Rooted in a deep commitment to its customers' financial wellbeing, Stash's platform is built with guardrails in place, helping Americans build wealth confidently and safely— with as little as $5 to start.

www.stash.com

Syfe

Syfe is a digital investment platform empowering people to build their wealth for a better future.

The company is creating a revolutionary wealth management experience for growing money to its fullest potential. Through its innovative investment tools, strategies and access to the latest insights, Syfe supports users in acting for their financial future, and managing their wealth in one destination.

www.syfe.com

Neo

Neo Financial is reimagining the Canadian banking experience by building next generation financial products from the ground up.

Neo offers a one-stop-shop for Canadians, with a supercharged cash back credit card, no-fee bank accounts, managed investments, and digital mortgages - all on one app.

www.neofinancial.com

ShopUp

98% of consumption in Bangladesh, one of Asia’s most fragmented retail markets, occurs through 4.5 million small neighborhood shops. These shops face daily struggles when procuring and distributing goods, and have limited access to formal financing. ShopUp is solving this with its full-stack B2B commerce platform: 'Mokam', a one-stop B2B commerce app; 'REDX', an end-to-end logistics platform; and 'Baki', a B2B buy now, pay later (BNPL) product for small shops.

shopup.org

Baraka

Baraka offers a modern brokerage experience with transparent pricing for investors across the Middle East.

Democratizing the investment space isn’t just about giving people access to financial markets – it’s about helping them understand how, when and why to invest. Baraka is empowering a new generation of investors across the Middle East by providing users with a highly intuitive, content-first platform to help them build their personal wealth over the long term.

getbaraka.com/en

Even

Even is the bank app that plans, so you don’t have to.

170 million Americans live paycheck to paycheck. Financial institutions charge those Americans over $100 billion each year in overdraft and payday loan fees. Even helps people break out of that cycle, with an automated financial manager, and the ability to safely withdraw wages ahead of payday.

(Acquired by Walmart, March 2022)

www.even.com

Moss

Moss helps thousands of businesses spend smarter. Its leading spend management solution encompasses corporate cards, invoice management, reimbursement and controlling modules that help finance teams save thousands of hours in manual data processing and gain complete control while enabling their teams.

en.getmoss.com

Ivy

Ivy is building a network of networks for instant bank payments.

Over 60 geographies around the world are currently rolling out instant bank payment infrastructure. Ivy is bringing these regional systems to a single point of access. Instant Bank Payments cuts out payment intermediaries, reducing transaction costs and increasing settlement speed for businesses.

getivy.io

Gaia

Gaia is the best way to pay for fertility treatment — with flexible options, unbeatable value, and transparent terms designed by people who get it. Gaia was born from our founder’s own journey through assisted fertility, and his resolve to build the experience he wished he had. Our mission is to give the best shot at parenthood to anyone who wants a family, with access to a network of clinics selected for their results, flexible payment options including guarantees, and 90+ NPS wraparound care and support.

gaiafamily.com

Wise

Wise is a peer-to-peer currency exchange service that allows its users to send money overseas easily and inexpensively.

Traditionally, large financial institutions dominated cross-currency transactions, charging hefty fees (often several percent of the amount sent) and taking hours or days to settle the trade. By coordinating transfer needs within countries across its massive user base, Wise makes transferring money more efficient and passes considerable savings along to users.

wise.com/us

Qonto

Qonto is the leading European business finance solution. It simplifies everything from everyday banking and financing to bookkeeping and spend management. With its fast and innovative product, highly responsive customer service, and transparent prices, Qonto energizes SMEs and freelancers so that they can achieve more.

qonto.com/en

Taxfix

Making complex tax systems accessible to everyone, Taxfix allows users to submit tax returns quickly and easily via app or web.

Tax filing with forms takes hours and requires expert knowledge. Taxfix disrupts the industry by offering an easy solution that guides users through the process of filing their taxes by asking them simple questions – as a tax advisor would. With its underlying tax engine, Taxfix's systems can generate the smartest questions and achieve the best refund for its customers.

taxfix.de/en

Bitpanda

Bitpanda simplifies wealth creation. Founded in 2014, Bitpanda exists to help people trust themselves enough to build financial freedom for their future.

With low fees, 24/7 trading, and real-time settlement, Bitpanda empowers both first-time investors and seasoned experts to invest in the cryptocurrencies, crypto indices, stocks, precious metals and commodities they want. So that they can shape their financial futures - on their own terms.

www.bitpanda.com/en

Parker

Parker's mission is to increase the number of financially independent people by providing the tools that enable independent business owners to scale their businesses profitably.

Parker's first product combines a corporate card with dynamic spending limits and software tooling to help businesses grow and optimize their profitability.

getparker.com

BukuWarung

BukuWarung's mission is to accelerate the financial success of small merchants in Indonesia.

BukuWarung provides an operating system to merchants that enables them to track business transactions, accept payments from customers, send payments to suppliers, buy digital services with an in-app wallet and give credit with underlying payment transactions.

bukuwarung.com

Novo

Novo is the award-winning, powerfully simple business banking platform built for small businesses.

Big banks don’t provide the access, assistance and modern tools that small business owners need to successfully grow their business. Novo is on a mission to increase the GDP of the modern small business by creating the go-to banking platform for SMBs as well as tools to help them save time and increase their cash flow.

www.novo.co

Bestow

Bestow is a leading enterprise platform transforming how life insurance and annuities are built, sold and serviced. Designed for top carriers, Bestow delivers modern infrastructure across quoting, application, underwriting, policy issuance, administration and in-force management. By consolidating fragmented systems into a single platform, Bestow helps accelerate product launches, reduce costs and unlock new growth opportunities for some of the world's largest insurers, including USAA, Transamerica and Nationwide.

www.bestow.com

Albo

albo is the leading Mexican neobank focused on middle/low income people and SMBs offering debit, credit, savings, and crypto products.

www.albo.mx

Mondu

Mondu is driving innovation in B2B payments by putting customers in the heart of the payment flow and ensuring a seamless, state-of-the-art user experience.

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms, both online and offline. As a result, businesses are empowered to purchase and pay when they want, leading to higher conversion and average order value, and driving growth for merchants and marketplaces.

www.mondu.ai

Petal

Petal is a new kind of credit card company on a mission to make credit honest, simple, and accessible.

Petal expands access to safe and affordable credit by underwriting cash flows instead of just credit scores, and helps users build credit and achieve better financial outcomes with behavioral science and smart, intuitive product design.

(Acquired by Empower Finance, April 2024)

www.petalcard.com

Xero

Xero provides cloud accounting software and services for small businesses and their advisors.

Xero fills the gap between legacy accounting systems trapped on the desktop and ad hoc systems by providing one clean and intuitive package with a full accrual accounting system, including cashbook, automated daily bank feeds, invoicing, payroll, sales tax and reporting.

(Initial Valar investment October 2010; final exit June 2020)

www.xero.com/us

Atlas

Atlas is building a members-only charge card for last minute access to coveted experiences.

atlascard.com

Kuda

Kuda, “the money app for Africans,” is on a mission to make financial services more accessible, affordable and rewarding for every African on the planet.

Beginning with Nigeria and the UK, Kuda is giving Africans – whether on the continent or in the diaspora – a better alternative to traditional finance by delivering services including free money transfers, business banking, automated savings, investments and instant access to credit through digital devices.

kuda.com

Regate

Regate is an accounting automation platform that streamlines accounting and financial processes for SMEs.

Designed as an intuitive all-in-one solution, Regate helps automate recurring tasks, centralize financial data and report actionable insights in real-time.

(Acquired by Qonto, March 2024)

en.regate.io

Hero

Hero is on a mission to disrupt the financial landscape for digital sellers across Europe. By providing a large range of instantly available credit options, its primary focus is to resolve the working capital crunch while saving its clients time and money.

Hero’s unified Financial Operating System brings banking, payments, and credit services under one roof. Available 24/7, its robust infrastructure massively enhances digital sellers' growth, operational efficiency, and financial flexibility.

www.heropay.co

Panacea

Created by doctors for doctors, Panacea offers customized banking products to assist through all career stages. From transitioning to residency to refinancing student loans to starting a new practice, Panacea is there for physicians, dentists, and veterinarians as their financial partner and is uniquely positioned to create the leading financial services company for doctors across the U.S.

panaceafinancial.com

Gaia

Gaia is the best way to pay for fertility treatment — with flexible options, unbeatable value, and transparent terms designed by people who get it. Gaia was born from our founder’s own journey through assisted fertility, and his resolve to build the experience he wished he had. Our mission is to give the best shot at parenthood to anyone who wants a family, with access to a network of clinics selected for their results, flexible payment options including guarantees, and 90+ NPS wraparound care and support.

gaiafamily.com

N26

N26 is building the first mobile bank the world loves to use. Founded in 2013 with a vision to change the world's relationship with money for the better, it has redesigned banking for the 21st century and is available 24/7 on Android, iOS, and desktop.

With state-of-the-art technology and no branch network, N26 is the first 100% mobile bank to receive a full banking license from the European Central Bank. Their intuitive, secure and seamless experience has been designed to empower everyone to achieve financial freedom with confidence.

n26.com/en-eu

Stash

Stash is an investing and banking app that simplifies personal finance for millions of everyday Americans.

Ninety-five percent of Stash customers are beginner and first-time investors who aspire for a better future for themselves and their families. Rooted in a deep commitment to its customers' financial wellbeing, Stash's platform is built with guardrails in place, helping Americans build wealth confidently and safely— with as little as $5 to start.

www.stash.com

Octane

Octane is revolutionizing recreational purchases by delivering a seamless, end-to-end digital buying experience. Octane connects people with their passions by combining cutting-edge technology and innovative risk strategies to make large lifestyle purchases – such as motorcycles, ATVs, snowmobiled and RVs – fast, easy, and accessible.

octane.co

Syfe

Syfe is a digital investment platform empowering people to build their wealth for a better future.

The company is creating a revolutionary wealth management experience for growing money to its fullest potential. Through its innovative investment tools, strategies and access to the latest insights, Syfe supports users in acting for their financial future, and managing their wealth in one destination.

www.syfe.com

Link

Link is on a mission to help businesses significantly reduce payment costs using open banking infrastructure.

Link provides businesses with an open-banking powered low-cost online payments solution. Link's seamless checkout experience enables consumers to pay with their bank accounts, driving significant cost savings to merchants.

www.link.money

Neo

Neo Financial is reimagining the Canadian banking experience by building next generation financial products from the ground up.

Neo offers a one-stop-shop for Canadians, with a supercharged cash back credit card, no-fee bank accounts, managed investments, and digital mortgages - all on one app.

www.neofinancial.com

Shares

Shares is the social investing app that helps people build their wealth through a community of peers and expert investors.

With Shares, everyone from investing rookies to financial veterans can buy stocks, ETFs and cryptocurrencies, spark conversations and learn from the best – all in a single app. Launched in the UK and expanding across the EU, Shares is on a mission to bring people together to build better financial futures.

shares.io

ShopUp

98% of consumption in Bangladesh, one of Asia’s most fragmented retail markets, occurs through 4.5 million small neighborhood shops. These shops face daily struggles when procuring and distributing goods, and have limited access to formal financing. ShopUp is solving this with its full-stack B2B commerce platform: 'Mokam', a one-stop B2B commerce app; 'REDX', an end-to-end logistics platform; and 'Baki', a B2B buy now, pay later (BNPL) product for small shops.

shopup.org

Velocity

Velocity is building the future of business financing in India.

Businesses in India have evolved but financial products haven’t. Velocity unlocks a company's growth by providing eCommerce analytics tools and revenue-based financing. Velocity also offers a first-of-its-kind corporate credit card, a seamless payments management platform, and much more to empower digital first businesses in India.

www.velocity.in

Baraka

Baraka offers a modern brokerage experience with transparent pricing for investors across the Middle East.

Democratizing the investment space isn’t just about giving people access to financial markets – it’s about helping them understand how, when and why to invest. Baraka is empowering a new generation of investors across the Middle East by providing users with a highly intuitive, content-first platform to help them build their personal wealth over the long term.

getbaraka.com/en

Simpl

Simpl is a checkout network in India that builds consumer trust in ecommerce by improving the user experience.

Traditionally, large ecommerce platforms have marginalized small and medium sized merchants selling online by owning the user experience and trust. Simpl is leveling the playfield for all by democratizing the checkout and post purchase experience in ecommerce transactions.

getsimpl.com

Even

Even is the bank app that plans, so you don’t have to.

170 million Americans live paycheck to paycheck. Financial institutions charge those Americans over $100 billion each year in overdraft and payday loan fees. Even helps people break out of that cycle, with an automated financial manager, and the ability to safely withdraw wages ahead of payday.

(Acquired by Walmart, March 2022)

www.even.com

Majority

MAJORITY is the first mobile banking app dedicated to providing migrants with the tools they need to succeed and thrive in the US.

MAJORITY is breaking down the barriers of banking and offering affordable cross-border services. For a low monthly fee, MAJORITY members in the U.S. gain access to key banking services, including an FDIC-insured account and Visa® debit card; plus, no-fee money transfers and low-cost international calling to help them connect home and support loved ones.

www.majority.com/en

Moss

Moss helps thousands of businesses spend smarter. Its leading spend management solution encompasses corporate cards, invoice management, reimbursement and controlling modules that help finance teams save thousands of hours in manual data processing and gain complete control while enabling their teams.

en.getmoss.com

One Trading

One Trading's goal is to bridge the gap between crypto and traditional asset trading with a single regulated trading venue for all customer types.

While offering both a regulated exchange and OTC desk, the company uses institutional grade technology to provide for the listing of securities and trading of spot, derivatives and structured products. One Trading brings trust and transparency to crypto markets.

onetrading.com

Ivy

Ivy is building a network of networks for instant bank payments.

Over 60 geographies around the world are currently rolling out instant bank payment infrastructure. Ivy is bringing these regional systems to a single point of access. Instant Bank Payments cuts out payment intermediaries, reducing transaction costs and increasing settlement speed for businesses.

getivy.io

LiveFlow

LiveFlow is an accounting and finance automation platform with a mission to help businesses better manage and understand their financials.

SMBs rely heavily on accounting firms to simplify their financials, but these firms are increasingly overwhelmed by manual, repetitive tasks. LiveFlow equips finance teams with tools to automate their mundane tasks, enabling them to serve more clients with fewer resources.

www.liveflow.comWise

Wise is a peer-to-peer currency exchange service that allows its users to send money overseas easily and inexpensively.

Traditionally, large financial institutions dominated cross-currency transactions, charging hefty fees (often several percent of the amount sent) and taking hours or days to settle the trade. By coordinating transfer needs within countries across its massive user base, Wise makes transferring money more efficient and passes considerable savings along to users.

wise.com/usQonto

Qonto is the leading European business finance solution. It simplifies everything from everyday banking and financing to bookkeeping and spend management. With its fast and innovative product, highly responsive customer service, and transparent prices, Qonto energizes SMEs and freelancers so that they can achieve more.

qonto.com/enTaxfix

Making complex tax systems accessible to everyone, Taxfix allows users to submit tax returns quickly and easily via app or web.

Tax filing with forms takes hours and requires expert knowledge. Taxfix disrupts the industry by offering an easy solution that guides users through the process of filing their taxes by asking them simple questions – as a tax advisor would. With its underlying tax engine, Taxfix's systems can generate the smartest questions and achieve the best refund for its customers.

taxfix.de/enBitpanda

Bitpanda simplifies wealth creation. Founded in 2014, Bitpanda exists to help people trust themselves enough to build financial freedom for their future.

With low fees, 24/7 trading, and real-time settlement, Bitpanda empowers both first-time investors and seasoned experts to invest in the cryptocurrencies, crypto indices, stocks, precious metals and commodities they want. So that they can shape their financial futures - on their own terms.

www.bitpanda.com/enParker

Parker's mission is to increase the number of financially independent people by providing the tools that enable independent business owners to scale their businesses profitably.

Parker's first product combines a corporate card with dynamic spending limits and software tooling to help businesses grow and optimize their profitability.

getparker.comBukuWarung

BukuWarung's mission is to accelerate the financial success of small merchants in Indonesia.

BukuWarung provides an operating system to merchants that enables them to track business transactions, accept payments from customers, send payments to suppliers, buy digital services with an in-app wallet and give credit with underlying payment transactions.

bukuwarung.comNovo

Novo is the award-winning, powerfully simple business banking platform built for small businesses.

Big banks don’t provide the access, assistance and modern tools that small business owners need to successfully grow their business. Novo is on a mission to increase the GDP of the modern small business by creating the go-to banking platform for SMBs as well as tools to help them save time and increase their cash flow.

www.novo.coBestow

Bestow is a leading enterprise platform transforming how life insurance and annuities are built, sold and serviced. Designed for top carriers, Bestow delivers modern infrastructure across quoting, application, underwriting, policy issuance, administration and in-force management. By consolidating fragmented systems into a single platform, Bestow helps accelerate product launches, reduce costs and unlock new growth opportunities for some of the world's largest insurers, including USAA, Transamerica and Nationwide.

www.bestow.comAlbo

albo is the leading Mexican neobank focused on middle/low income people and SMBs offering debit, credit, savings, and crypto products.

www.albo.mxMondu

Mondu is driving innovation in B2B payments by putting customers in the heart of the payment flow and ensuring a seamless, state-of-the-art user experience.

Mondu's solution enables merchants and marketplaces to offer their business customers the most popular B2B payment methods and flexible payment terms, both online and offline. As a result, businesses are empowered to purchase and pay when they want, leading to higher conversion and average order value, and driving growth for merchants and marketplaces.

www.mondu.aiPetal

Petal is a new kind of credit card company on a mission to make credit honest, simple, and accessible.

Petal expands access to safe and affordable credit by underwriting cash flows instead of just credit scores, and helps users build credit and achieve better financial outcomes with behavioral science and smart, intuitive product design.

(Acquired by Empower Finance, April 2024)

www.petalcard.comXero

Xero provides cloud accounting software and services for small businesses and their advisors.

Xero fills the gap between legacy accounting systems trapped on the desktop and ad hoc systems by providing one clean and intuitive package with a full accrual accounting system, including cashbook, automated daily bank feeds, invoicing, payroll, sales tax and reporting.

(Initial Valar investment October 2010; final exit June 2020)

www.xero.com/usAtlas

Atlas is building a members-only charge card for last minute access to coveted experiences.

atlascard.comKuda

Kuda, “the money app for Africans,” is on a mission to make financial services more accessible, affordable and rewarding for every African on the planet.

Beginning with Nigeria and the UK, Kuda is giving Africans – whether on the continent or in the diaspora – a better alternative to traditional finance by delivering services including free money transfers, business banking, automated savings, investments and instant access to credit through digital devices.

kuda.comRegate

Regate is an accounting automation platform that streamlines accounting and financial processes for SMEs.

Designed as an intuitive all-in-one solution, Regate helps automate recurring tasks, centralize financial data and report actionable insights in real-time.

(Acquired by Qonto, March 2024)

en.regate.ioHero

Hero is on a mission to disrupt the financial landscape for digital sellers across Europe. By providing a large range of instantly available credit options, its primary focus is to resolve the working capital crunch while saving its clients time and money.

Hero’s unified Financial Operating System brings banking, payments, and credit services under one roof. Available 24/7, its robust infrastructure massively enhances digital sellers' growth, operational efficiency, and financial flexibility.

www.heropay.coPanacea

Created by doctors for doctors, Panacea offers customized banking products to assist through all career stages. From transitioning to residency to refinancing student loans to starting a new practice, Panacea is there for physicians, dentists, and veterinarians as their financial partner and is uniquely positioned to create the leading financial services company for doctors across the U.S.

panaceafinancial.comGaia

Gaia is the best way to pay for fertility treatment — with flexible options, unbeatable value, and transparent terms designed by people who get it. Gaia was born from our founder’s own journey through assisted fertility, and his resolve to build the experience he wished he had. Our mission is to give the best shot at parenthood to anyone who wants a family, with access to a network of clinics selected for their results, flexible payment options including guarantees, and 90+ NPS wraparound care and support.

gaiafamily.comN26

N26 is building the first mobile bank the world loves to use. Founded in 2013 with a vision to change the world's relationship with money for the better, it has redesigned banking for the 21st century and is available 24/7 on Android, iOS, and desktop.

With state-of-the-art technology and no branch network, N26 is the first 100% mobile bank to receive a full banking license from the European Central Bank. Their intuitive, secure and seamless experience has been designed to empower everyone to achieve financial freedom with confidence.

n26.com/en-euStash

Stash is an investing and banking app that simplifies personal finance for millions of everyday Americans.

Ninety-five percent of Stash customers are beginner and first-time investors who aspire for a better future for themselves and their families. Rooted in a deep commitment to its customers' financial wellbeing, Stash's platform is built with guardrails in place, helping Americans build wealth confidently and safely— with as little as $5 to start.

www.stash.comOctane

Octane is revolutionizing recreational purchases by delivering a seamless, end-to-end digital buying experience. Octane connects people with their passions by combining cutting-edge technology and innovative risk strategies to make large lifestyle purchases – such as motorcycles, ATVs, snowmobiled and RVs – fast, easy, and accessible.

octane.coSyfe

Syfe is a digital investment platform empowering people to build their wealth for a better future.

The company is creating a revolutionary wealth management experience for growing money to its fullest potential. Through its innovative investment tools, strategies and access to the latest insights, Syfe supports users in acting for their financial future, and managing their wealth in one destination.

www.syfe.comLink

Link is on a mission to help businesses significantly reduce payment costs using open banking infrastructure.

Link provides businesses with an open-banking powered low-cost online payments solution. Link's seamless checkout experience enables consumers to pay with their bank accounts, driving significant cost savings to merchants.

www.link.moneyNeo

Neo Financial is reimagining the Canadian banking experience by building next generation financial products from the ground up.

Neo offers a one-stop-shop for Canadians, with a supercharged cash back credit card, no-fee bank accounts, managed investments, and digital mortgages - all on one app.

www.neofinancial.comShares

Shares is the social investing app that helps people build their wealth through a community of peers and expert investors.

With Shares, everyone from investing rookies to financial veterans can buy stocks, ETFs and cryptocurrencies, spark conversations and learn from the best – all in a single app. Launched in the UK and expanding across the EU, Shares is on a mission to bring people together to build better financial futures.

shares.ioShopUp

98% of consumption in Bangladesh, one of Asia’s most fragmented retail markets, occurs through 4.5 million small neighborhood shops. These shops face daily struggles when procuring and distributing goods, and have limited access to formal financing. ShopUp is solving this with its full-stack B2B commerce platform: 'Mokam', a one-stop B2B commerce app; 'REDX', an end-to-end logistics platform; and 'Baki', a B2B buy now, pay later (BNPL) product for small shops.

shopup.orgVelocity

Velocity is building the future of business financing in India.

Businesses in India have evolved but financial products haven’t. Velocity unlocks a company's growth by providing eCommerce analytics tools and revenue-based financing. Velocity also offers a first-of-its-kind corporate credit card, a seamless payments management platform, and much more to empower digital first businesses in India.

www.velocity.inBaraka

Baraka offers a modern brokerage experience with transparent pricing for investors across the Middle East.

Democratizing the investment space isn’t just about giving people access to financial markets – it’s about helping them understand how, when and why to invest. Baraka is empowering a new generation of investors across the Middle East by providing users with a highly intuitive, content-first platform to help them build their personal wealth over the long term.

getbaraka.com/enSimpl

Simpl is a checkout network in India that builds consumer trust in ecommerce by improving the user experience.

Traditionally, large ecommerce platforms have marginalized small and medium sized merchants selling online by owning the user experience and trust. Simpl is leveling the playfield for all by democratizing the checkout and post purchase experience in ecommerce transactions.

getsimpl.comEven

Even is the bank app that plans, so you don’t have to.

170 million Americans live paycheck to paycheck. Financial institutions charge those Americans over $100 billion each year in overdraft and payday loan fees. Even helps people break out of that cycle, with an automated financial manager, and the ability to safely withdraw wages ahead of payday.

(Acquired by Walmart, March 2022)

www.even.comMajority

MAJORITY is the first mobile banking app dedicated to providing migrants with the tools they need to succeed and thrive in the US.

MAJORITY is breaking down the barriers of banking and offering affordable cross-border services. For a low monthly fee, MAJORITY members in the U.S. gain access to key banking services, including an FDIC-insured account and Visa® debit card; plus, no-fee money transfers and low-cost international calling to help them connect home and support loved ones.

www.majority.com/enMoss

Moss helps thousands of businesses spend smarter. Its leading spend management solution encompasses corporate cards, invoice management, reimbursement and controlling modules that help finance teams save thousands of hours in manual data processing and gain complete control while enabling their teams.

en.getmoss.comOne Trading

One Trading's goal is to bridge the gap between crypto and traditional asset trading with a single regulated trading venue for all customer types.

While offering both a regulated exchange and OTC desk, the company uses institutional grade technology to provide for the listing of securities and trading of spot, derivatives and structured products. One Trading brings trust and transparency to crypto markets.

onetrading.comIvy

Ivy is building a network of networks for instant bank payments.

Over 60 geographies around the world are currently rolling out instant bank payment infrastructure. Ivy is bringing these regional systems to a single point of access. Instant Bank Payments cuts out payment intermediaries, reducing transaction costs and increasing settlement speed for businesses.

getivy.ioLiveFlow

LiveFlow is an accounting and finance automation platform with a mission to help businesses better manage and understand their financials.

SMBs rely heavily on accounting firms to simplify their financials, but these firms are increasingly overwhelmed by manual, repetitive tasks. LiveFlow equips finance teams with tools to automate their mundane tasks, enabling them to serve more clients with fewer resources.

www.liveflow.com

We seek out exceptionally focused teams with large ambitions. We believe that founders are best positioned to lead their start-ups, and that they should retain substantial equity and control.

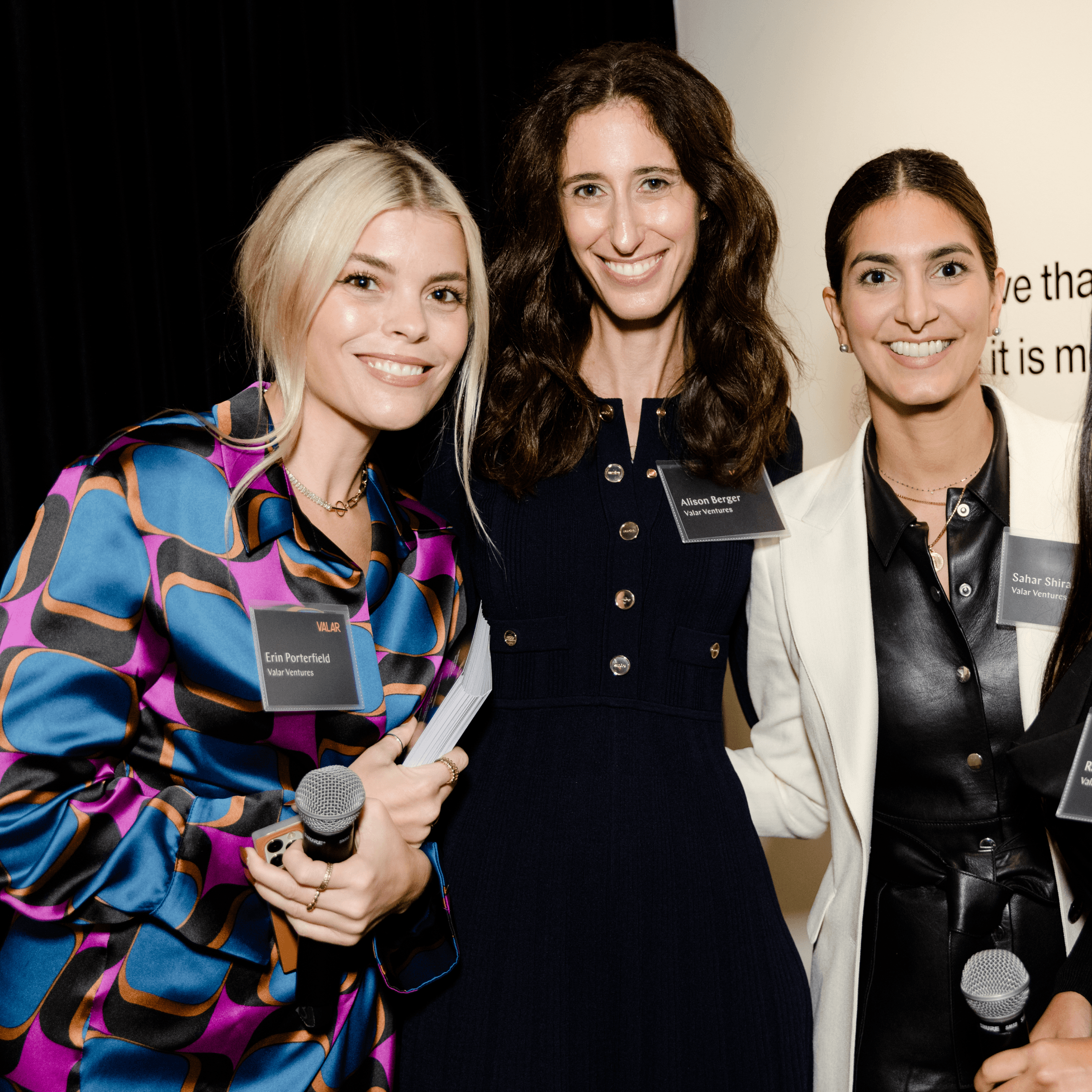

Alison Berger

Alison is the firm's Chief Financial Officer, responsible for all financial and tax reporting matters.

Prior to joining Valar, she worked at Revlon Canada and Molson Coors Brewing Company in various corporate accounting and finance roles. Before joining Molson Coors, Alison worked as an accountant in the Montreal office of Richter LLP. Alison received an undergraduate degree in Accounting and Strategic Management from McGill University and is a member of the Chartered Professional Accountants of Canada.

Andrew McCormack

Andrew is a founder and Managing Partner at Valar Ventures. Andrew’s career in technology has included business and corporate development roles at eCount (acquired by Citicorp) and Yahoo! He joined PayPal in 2001, where he worked closely with Peter in preparing for the company’s IPO. After PayPal’s sale to eBay, Andrew helped launch Clarium Capital and later founded a restaurant group in San Francisco.

In 2008, Andrew rejoined Peter at Thiel Capital, where he led various international initiatives for Thiel Capital and Peter personally. Andrew received his B.A. in Political Science from the University of Pennsylvania.

Erin Porterfield

As Valar’s first employee, Erin has worked closely with James and Andrew since the firm’s founding.

Prior to joining Valar, Erin worked with James at Thiel Capital as his executive assistant from 2011-2013. Erin received her Bachelor of Science, Broadcast Journalism degree from Middle Tennessee State University.

Giff Carter

Giff joined Valar in 2022 to help with portfolio company performance and investor communications.

Prior to joining Valar, Giff co-founded a marketplace startup, served as Stash’s chief commercial officer, and spent a decade at ING/Voya. Prior to ING, Giff practiced M&A law for five years in the New York office of Skadden, Arps, Slate, Meagher & Flom LLP. Prior to attending law school, Giff was a Lieutenant in the U.S. Navy. Giff received his J.D. and B.A. from Boston University.

Sahar Shirazi

Sahar Shirazi joined Valar in 2022 to assist with legal and operational issues for the firm and its portfolio companies.

Prior to joining Valar, Sahar practiced venture and technology law with Holland & Knight and Dentons. Sahar received her J.D. from the University of Virginia and her B.S. from Cornell University.

James Fitzgerald

James is a founder and Managing Partner at Valar Ventures. Prior to Valar, he was COO and General Counsel of Peter Thiel’s global parent company, Thiel Capital, where he helped manage Peter’s global network of investments and businesses, including Founders Fund and Clarium.

Prior to joining Thiel Capital, James practiced law for seven years in the New York office of Skadden, Arps, Slate, Meagher & Flom LLP. He received his J.D. from the University of California, Los Angeles and his undergraduate degree from Brigham Young University.

Reuben Kobulnik

Reuben, who has been with the firm since 2014, is the firm’s Operating Partner, responsible for all operational, financial reporting and legal matters.

Prior to joining Valar, Reuben was Counsel at Skadden, Arps, Slate, Meagher & Flom LLP, where he practiced M&A, private equity and general corporate law for nine years. Before joining Skadden, Reuben clerked for Justice Morris J. Fish of the Supreme Court of Canada. Reuben received his law degree as well as an undergraduate degree in Finance and Strategy from McGill University.

Elina Rayberg

Elina joined Valar in 2024 as the firm's first European investor. Based in London, she helps manage Valar's European portfolio and source new opportunities in the region.

Prior to joining Valar, Elina worked at an early-stage generalist fund, Singular, where she helped build out their London presence. Earlier in her career, Elina led and worked on Fintech B2B SaaS investments at RTP Global and was an investment banker at Perella Weinberg Partners. Elina received her MS Degree in Finance and Accounting from Imperial College, London and her BSs Degree in Business Management from Queen Mary, University of London.

Rachel Phan

Rachel joined Valar in 2021 to assist Alison with all financial and tax reporting matters.

Prior to joining Valar formally, Rachel advised Valar as a senior associate in Standish Management’s private fund administration practice. Rachel received her B.B.A from Loyola University Chicago.

Alison Berger

Alison is the firm's Chief Financial Officer, responsible for all financial and tax reporting matters.

Prior to joining Valar, she worked at Revlon Canada and Molson Coors Brewing Company in various corporate accounting and finance roles. Before joining Molson Coors, Alison worked as an accountant in the Montreal office of Richter LLP. Alison received an undergraduate degree in Accounting and Strategic Management from McGill University and is a member of the Chartered Professional Accountants of Canada.

Sahar Shirazi

Sahar Shirazi joined Valar in 2022 to assist with legal and operational issues for the firm and its portfolio companies.

Prior to joining Valar, Sahar practiced venture and technology law with Holland & Knight and Dentons. Sahar received her J.D. from the University of Virginia and her B.S. from Cornell University.

Andrew McCormack

Andrew is a founder and Managing Partner at Valar Ventures. Andrew’s career in technology has included business and corporate development roles at eCount (acquired by Citicorp) and Yahoo! He joined PayPal in 2001, where he worked closely with Peter in preparing for the company’s IPO. After PayPal’s sale to eBay, Andrew helped launch Clarium Capital and later founded a restaurant group in San Francisco.

In 2008, Andrew rejoined Peter at Thiel Capital, where he led various international initiatives for Thiel Capital and Peter personally. Andrew received his B.A. in Political Science from the University of Pennsylvania.

James Fitzgerald

James is a founder and Managing Partner at Valar Ventures. Prior to Valar, he was COO and General Counsel of Peter Thiel’s global parent company, Thiel Capital, where he helped manage Peter’s global network of investments and businesses, including Founders Fund and Clarium.

Prior to joining Thiel Capital, James practiced law for seven years in the New York office of Skadden, Arps, Slate, Meagher & Flom LLP. He received his J.D. from the University of California, Los Angeles and his undergraduate degree from Brigham Young University.

Erin Porterfield

As Valar’s first employee, Erin has worked closely with James and Andrew since the firm’s founding.

Prior to joining Valar, Erin worked with James at Thiel Capital as his executive assistant from 2011-2013. Erin received her Bachelor of Science, Broadcast Journalism degree from Middle Tennessee State University.

Reuben Kobulnik

Reuben, who has been with the firm since 2014, is the firm’s Operating Partner, responsible for all operational, financial reporting and legal matters.

Prior to joining Valar, Reuben was Counsel at Skadden, Arps, Slate, Meagher & Flom LLP, where he practiced M&A, private equity and general corporate law for nine years. Before joining Skadden, Reuben clerked for Justice Morris J. Fish of the Supreme Court of Canada. Reuben received his law degree as well as an undergraduate degree in Finance and Strategy from McGill University.

Giff Carter

Giff joined Valar in 2022 to help with portfolio company performance and investor communications.

Prior to joining Valar, Giff co-founded a marketplace startup, served as Stash’s chief commercial officer, and spent a decade at ING/Voya. Prior to ING, Giff practiced M&A law for five years in the New York office of Skadden, Arps, Slate, Meagher & Flom LLP. Prior to attending law school, Giff was a Lieutenant in the U.S. Navy. Giff received his J.D. and B.A. from Boston University.

Elina Rayberg

Elina joined Valar in 2024 as the firm's first European investor. Based in London, she helps manage Valar's European portfolio and source new opportunities in the region.

Prior to joining Valar, Elina worked at an early-stage generalist fund, Singular, where she helped build out their London presence. Earlier in her career, Elina led and worked on Fintech B2B SaaS investments at RTP Global and was an investment banker at Perella Weinberg Partners. Elina received her MS Degree in Finance and Accounting from Imperial College, London and her BSs Degree in Business Management from Queen Mary, University of London.

Rachel Phan

Rachel joined Valar in 2021 to assist Alison with all financial and tax reporting matters.

Prior to joining Valar formally, Rachel advised Valar as a senior associate in Standish Management’s private fund administration practice. Rachel received her B.B.A from Loyola University Chicago.

We are built to move quickly and decisively. Every team gets our entire partnership behind them from day one.

We are built to move quickly and decisively. Every team gets our entire partnership behind them from day one.